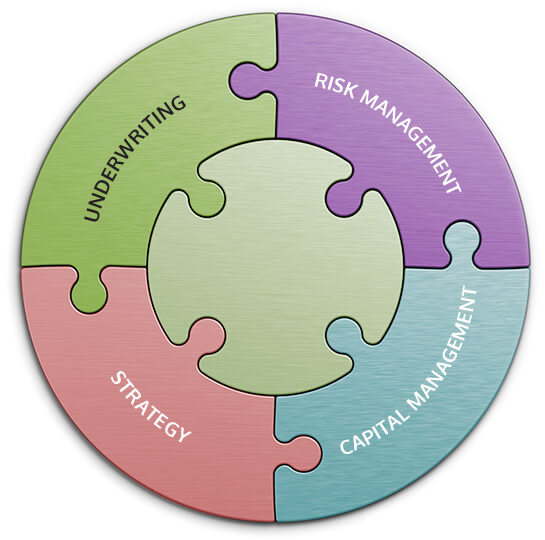

Our Focus

ReThink’s focus is in the areas of Underwriting, Risk Management, Capital Management and Strategy – the key drivers in building and managing a successful (re)insurance business.

Our Services

Analysis

+Analysis

We support our clients with data-driven analysis, delivered through the lens of deep experience in the (re)insurance sector. ReThink provides quantitative and qualitative assessment of underwriting, risk management and capital management processes, and works with customers to identify areas for improvement. Where projects require specialized financial, actuarial or underwriting resources, we leverage our network of experts to bring the right skills to bear.

Advisory

+Advisory

We provide our clients with access to deep (re)insurance expertise and practical, fact-based advisory services. ReThink assists with business formations in Bermuda and the US, helps develop and vet business plans, advises on regulatory and rating agency matters, provides due diligence support and acts as a thought partner in evaluating strategic alternatives.

Governance

+Governance

We assist our clients in developing a thoughtful and practical governance structure that supports their business and satisfies regulators, rating agencies and customers. ReThink provides support in developing appropriate governance processes and documentation, including underwriting and investment guidelines. We have developed business plans and materials for rating agencies such as AM Best, and regulators such as the Bermuda Monetary Authority. ReThink also provides board level support, including identifying qualified independent directors.

Meet Tom Hulst

Tom is the President and Founder of ReThink. He also currently serves as a non executive director for several insurers, is a member of the executive committee of the Association of Bermuda International Companies (ABIC), and is President of the Atlantic Conservation Partnership, a US 501(c)(3) organization charity which focuses on environmental issues impacting the US and Bermuda.

Tom has led businesses in the US, Bermuda, London (Lloyd’s) and Zurich, meeting and transacting with the reinsurance buyers and senior management of the majority of US and International insurers. He has over 20 years of working relationships with a range of investors, distribution sources, regulators and rating agencies in multiple jurisdictions. Tom previously served on the board of the Reinsurance Association of America (RAA) as well as the Association of Bermuda Insurers and Reinsurers (ABIR).

From 2005-2015 Tom was part of the founding management team of Ariel Reinsurance Company, a $1b private equity led startup, serving as CEO from 2008-2015, through the sale of the business to Goldman Sachs in 2012 and subsequent spin out of the Goldman Sachs Reinsurance Group into the Global Atlantic Financial Group. During that time he drove Ariel’s steady and successful diversification into new lines of business and broadened the geographic footprint into Zurich, Brazil, and US while achieving top quartile operating results by focusing on risk selection, technology, and capital management. Ariel’s Lloyd’s vehicle, Syndicate 1910, attained Tier 1 syndicate ranking and the 2nd best loss ratio within Lloyd’s.

Prior to joining Ariel Re, Mr. Hulst held progressively senior roles within the General Re Group, beginning as a casualty facultative underwriter. He gained start up experience as part of the initial underwriting team forming Starr Excess Liability Insurance Company in Bermuda, and served as Vice President at both Gen Re Financial Products, offering derivative and structured finance solutions to the Insurance industry, and Gen Re Capital Consultants, which used advanced quantitative tools to provide asset and liability management advice to insurers. Tom also acted as a treaty account executive, managing client relationships and working with insurers on both traditional reinsurance transactions as well as capital market alternatives.

Tom graduated cum laude from both the University of Michigan and the J.L Kellogg School of Management at Northwestern.